Welcome back to News Channel 9 at 6:00. With tax deadlines quickly approaching, one woman says she is not getting the answer she deserved from a tax preparation company. She filed her taxes through Liberty Tax Service about two months ago and says they did not file it properly. Now she's left with unfiled taxes and she's out hundreds of dollars. News Channel's Alisa Sparano has the story and what you need to do to protect your money. "I mean, $632 dollars out of a $2,300 refund, that's a third of my refund," Melissa Stewart walked into this Dalton Liberty Tax hoping to get the most out of this year's tax return. But she realized they made a big mistake. "It actually stayed put in my packet and everything but it was not filed." Stuart says the tax preparer failed to include one of her two W-2s, the difference hundreds of dollars. She referred to the company's website for guidance and noticed this satisfaction guarantee, claiming the office will refund preparation fees if you're not 100 percent satisfied. But after Stuart tried getting her money back, the office refused, saying it's too late. "They said that if I would have said something the day that they filed it, that they could have reduced it to $632 greatly for me. But now there was nothing they can do about it. They're guaranteeing satisfaction, if you will, but they have, it appears from what you tell me, they have made a mistake." She presented them with two W-2 forms and they all included one of them in the preparation. James Winset of the Better Business Bureau says he's hearing stories like Stewart's aren't that uncommon. He says in the future, the best thing anyone can do ahead of time is research Liberty Tax. "If...

Award-winning PDF software

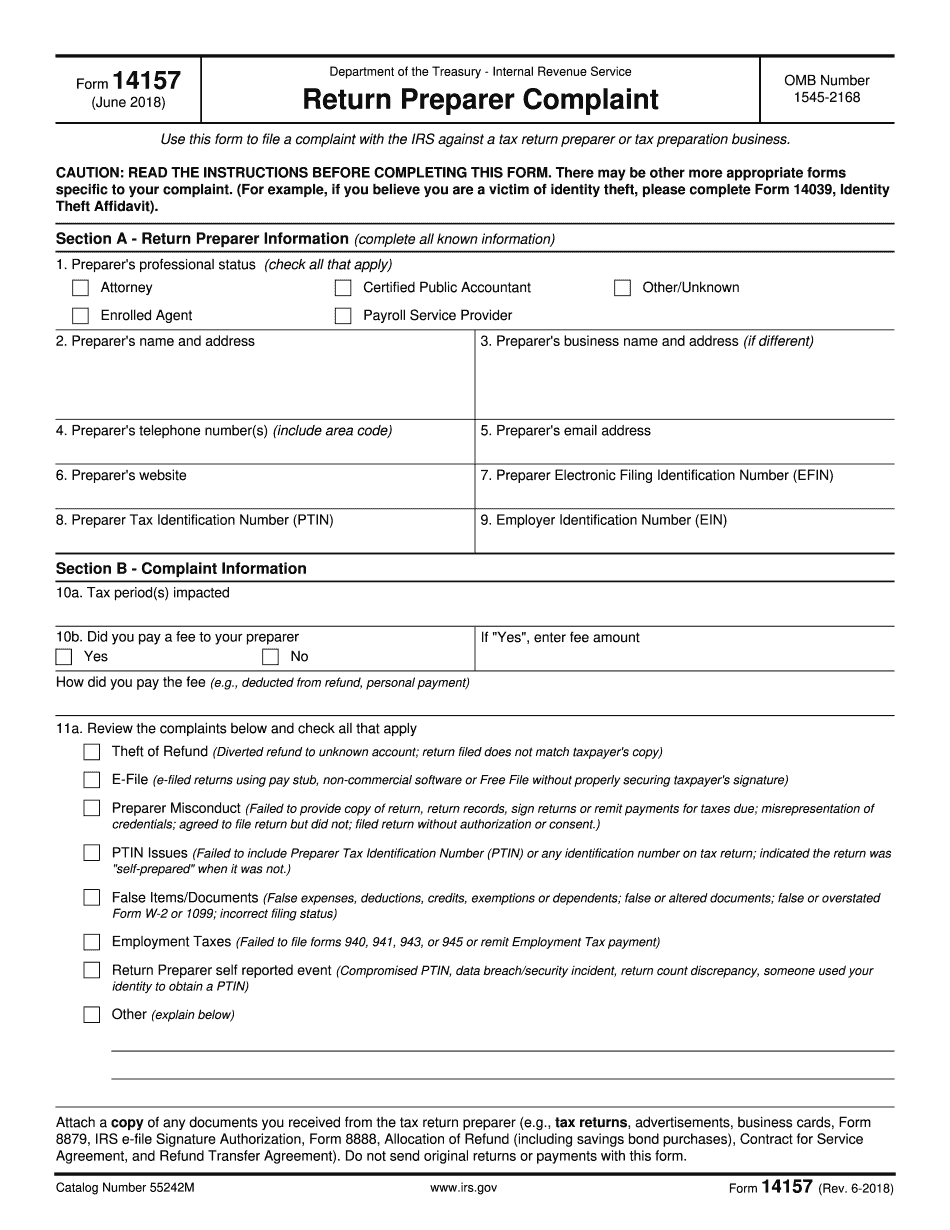

How to file a complaint against a tax preparer Form: What You Should Know

You may also contact your state's bar Association for assistance as well. Who To File A Complaint — Department of Consumer Affairs, California If you want to file a complaint with the CBA, there are four different ways that you can file your complaint: (1) online, (2) on paper, (3) by mail or (4) fax. For your convenience, we have created an online complaint form and a paper complaint form. Submit a letter requesting a complaint form online to: Complaints Office Cal. Tax-Exempt & Government Entities Division State Bar of California 500 Golden Gate Avenue, Suite 1900 San Francisco, CA 94105 Send: Complaints Office Cal. Tax-Exempt & Government Entities Division State Bar of California 500 Golden Gate Avenue, Suite 1900 San Francisco, CA 94105 Complaints to the State Bar are mailed within 7 business days. If there are no complaints to your satisfaction in the last 10 years, you should have the best possible chance of receiving an informal letter back from the BOC, however it is likely that you will never see a formal response. For further information and how to file an informal complaint on paper, check here. How To File A Complaint — Office of the State Auditor, California If you file your complaint online, use the “Informal” complaint form (also known as the “Form 2855”). If you wish to file your complaint orally, you will need to bring in the applicable form with you. To obtain this form, call. To request a complaint form written by email, fax, or in color, you can fill out and fax the appropriate form to: Office of the State Auditor California Office of the State Auditor 50 East Market Street Sacramento, CA 95 For example, if your complaint takes the form of a “Declaration of Policy” you must submit your request under the following email address: Alternatively, you may drop a request by mail using the enclosed form. Where to File A Complaint California has a list of common taxpayers by taxpayer's taxpayer code. This allows you to easily find the address for filing your complaint by type of taxpayer. For convenience, we have provided these addresses for people who are filing their complaints electronically.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to file a complaint against a tax preparer