Hi everyone, I'm Roger Kinect, President of Universal Accounting Center. I'm excited because we have a wonderful presentation planned this morning with an expert, Ron Mueller, in tax law. He will be discussing how tax law affects small businesses, especially for accountants and tax preparers like you. As we approach the pre-tax season, it is important to emphasize the concept of tax planning and being proactive in helping our clients maximize their legal deductions. Are you aware of the 53 changes that have recently happened with the signing of the 2018 tax cuts and Jobs Act? This act, which was 500 plus pages long, was signed into law in 2017 but affects this year's tax season. It is crucial for accounting professionals to understand these changes, as there are numerous people still waiting for guidance and clarification from Washington and the IRS on these important tax deductions. These 53 deductions include modifications, enhancements, and eliminations that you need to be aware of, as your clients may have certain expectations based on previous years' deductions. Some popular tax deductions are no longer available, while there are new tax deductions that can greatly benefit small business owners. It is important for tax preparers and accountants to be knowledgeable about these changes, as many small business owners are unaware of them. I understand that these statements may seem broad, but they are designed to help you better serve your clients. This is your opportunity to stay informed and make the most of the 2018 tax act. That's why I have asked Dr. Ron Mueller to record this brief training on the impact of the 2018 tax act on America's small businesses and home-based business owners. Use this training to become familiar with the changes and ensure you can provide the best service to your clients.

Award-winning PDF software

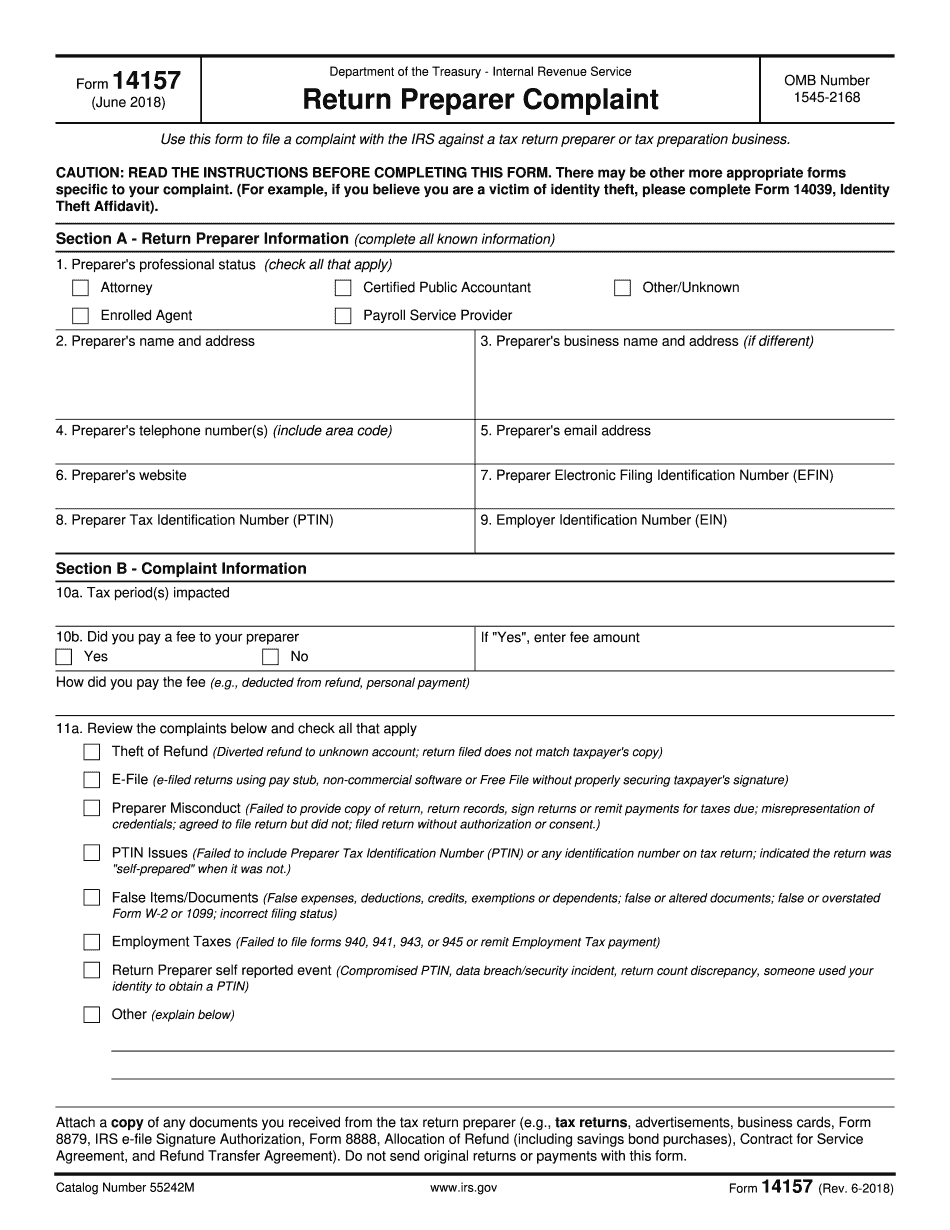

Tax preparer misconduct Form: What You Should Know

IRS Form 14157-A — fill-in IRS 14157-A and IRS Form 14157-A-2009(a) form are the form to use if you wish to file a formal tax return fraud or misconduct case against a tax return preparer and do not have a court filing, due process, or federal tax return preparation case. IRS Form 14157-A and IRS Form 14157-A-2009(a) are the form to use if you are a citizen of another country who wants to report to the IRS the fraudulent or criminal activity of someone who is a resident of any country, but you do not have a court filing, due process, or federal tax return preparation case. Tax Return Preparer Fraud or Misconduct Affidavit Form 14157 must be presented to the IRS immediately after the fraudulent return has been filed or altered. When a tax return preparer willfully and intentionally reports to the IRS that the return preparer prepared and filed an additional return or amended a previously filed return, which has any tax consequences other than a refund, the employee will be subject to the potential loss of employment benefits and other tax consequences. The employee will be liable for the filing of the false tax return report. The IRS will not accept a completed Form 14157-A, an amended form or an amended return (including amended returns filed with the incorrect information), as proof of the payment, including interest and penalties, of taxes due. However, if a tax return preparer knowingly fails to file any tax return for two years, he or she will be liable for all tax due, including interest, on the return without the ability to deduct those taxes from income. A form 14157-A is available to assist taxpayers in filing a tax return fraud or misconduct report. You can download a downloadable copy of tax form 14157. The OMB Guidance Statement provides guidance on the use of the OMB Form 14157. Taxpayers may call for assistance. Online services for Tax Return Preparer Fraud or Misconduct Complaint You can access a service that may assist you in filing a tax return fraud or misconduct report at IRS.gov. When you request information on IRS services, you will be connected to a live agent who will ask you simple questions to help you complete your return and submit it electronically. Tax Center, U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax preparer misconduct