Award-winning PDF software

My tax preparer is being investigated Form: What You Should Know

S. Immigration and Customs Enforcement, Attn: CID, Washington, DC 20. Sep 11, 2025 — Report suspected tax fraud with a government agency · Phone: / Mail Stop 421-D, U.S. Immigration and Customs Enforcement, Attn: CID, Washington, DC 20. May 16, 2025 — Forfeiture of property of an individual who willfully fails to pay income taxes on return due to a failure to report a payment that the individual made to another person, a non-U.S. person with the intent to avoid U.S. income tax, or to obtain a benefit from a person who willfully failed to report a payment the individual made to another person, or other similar circumstances in which the court may deem such property to have been obtained as part of or in furtherance of a criminal conspiracy. Report suspicious activity to the federal Internal Revenue Service by completing this form. If you suspect your tax preparer has committed one or more of the tax fraud or fraud related crimes discussed below, or has been issued an administrative penalty/penalty enforcement letter for such conduct, you must report your concern to the Federal Bureau of Investigation (FBI) or Department of the Treasury, Internal Revenue Service. You are not required to report this type of concern to the local IRS law enforcement agency. What to do If You Have Concerns About Tax Preparers If there has been a complaint made about your tax preparer, you should follow these guidelines to make sure you are providing truthful, accurate information about the tax preparer. 1. Contact the IRS Taxpayer Advocate Service (TAS) at, or use this Taxpayer Advocate Service Form 22-1118. The IRS should contact you to discuss your concerns. 2. Request to speak to a TAS representative who may be able to assist you with resolving your concerns. A TAS representative may also be able to assist you by taking any needed documentation and creating a letter of analysis (Form 2350B). If you have concerns about your tax preparer or about an IRS action you have taken against your preparer or your refund request that you believe is flawed, you should have an attorney review the evidence. If you have the proper documentation, discuss your concerns with an independent attorney who is willing to review such evidence and decide on a course of action.

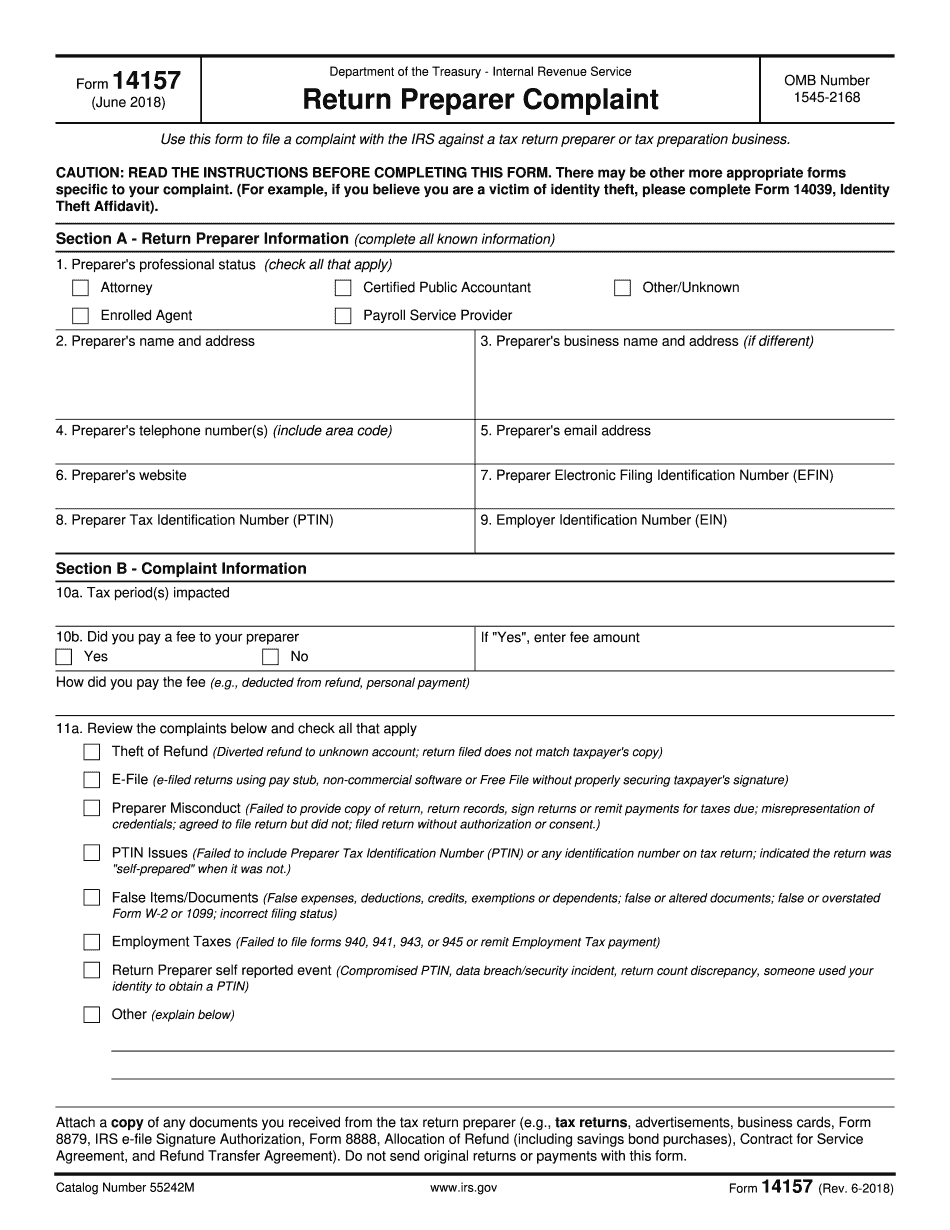

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.