A taking action investigation alert tonight on this final week before the tax deadline. Your income tax refund could get eaten away by excessive fees. Fees that come as a big surprise. Tonight, we have a warning that could save you hundreds of dollars now and in the future. Here's what happened after a taxpayer came to a storefront Tax Office last year. Tiffany Abrams says she simply wanted a two-hundred-dollar holiday loan, often used for quick cash around Christmas. In the end, she was charged a lot more - 861 dollars for a two-hundred-dollar long. But after receiving the cash, she was surprised to learn the company had filed her federal taxes without her permission. 861 dollars deducted directly from her tax refund in fees. "I never... after. I didn't know, and I have my w-2s right with me. I never took him," says Tiffany. A December pay stub supplied for the loan was used instead. Sue McConnell is with a Better Business Bureau. "Consumers are just surprised that they run into hundreds of dollars and the amounts of fees that are tacked on. And of course, this is all removed. They don't get that in their refund." Some of the consumers are also complaining. Similar complaints have caught the eye of federal investigators. Just in the last six months, 30 tax preparers nationwide have been shut down. The Florida Attorney General's Office tells the i-team there were 94 complaints against tax services statewide in the last two years. In February, in Brooksville and Spring Hill, Hernando County investigators searched 2lbs Tax Services offices. That investigation continues. So, what can you do to protect yourself? Both the Better Business Bureau and the Florida Attorney General's Office recommend checking with them about complaint histories of tax preparers before you agree to...

Award-winning PDF software

Tax preparer filed my taxes without my consent Form: What You Should Know

Form T542A2 — Return Preparation Services — Canada.ca May 18, 2025 — Your client may use the list information in this manner without taxpayer consent because A is providing tax information for financial/business/educational purpose. The use of information in a form such as Form 1040T, which does not list any specific name, may constitute unauthorized use and may be an unauthorized disclosure of a taxpayer's confidential tax information. Filing Requirements — Canada.ca The federal government requires taxpayers to file their return electronically or print it from an automated return printer. Use Form 941-X, Authorization to File, to provide consent to a return preparer. If you are having difficulties with your return preparation, contact the IRS at or IRS-TDDirs.gov. You may also contact the Department of Financial Services. Filing Requirements — TaxTips.com The federal government requires taxpayers to file their return electronically or print it from an automated return printer. Contact each CRA for their regulations regarding electronic filing. The use of information in an address on a form such as Form 1040T, which does not list any specific name, may constitute unauthorized use and may be an unauthorized disclosure of a taxpayer's confidential tax information. Eligibility Form — Canada.ca Taxpayers who use TaxTips.com to help prepare their return will be added to our electronic return file. TaxTips.com has no connection to the IRS. However, TaxTips.com has partnered with the IRS to provide taxpayers with tax returns that they can use on Tactics. In most cases, you will be added to this list if the same name appears on both forms to which you were assigned. You will not be added to this list if the same name does not appear on both forms. You may request an electronic confirmation of the submission of your return. The return must be received by the end of the Business Day following receipt. If the return is not received, a return could also not be electronically filed. File Your Taxes in One Day — TaxTips.com Use IRS.gov Online to file your federal income tax return online with no trip to a Tactics.com-certified tax firm, and no wait times to get your tax information in. If you still need help you can contact us at.

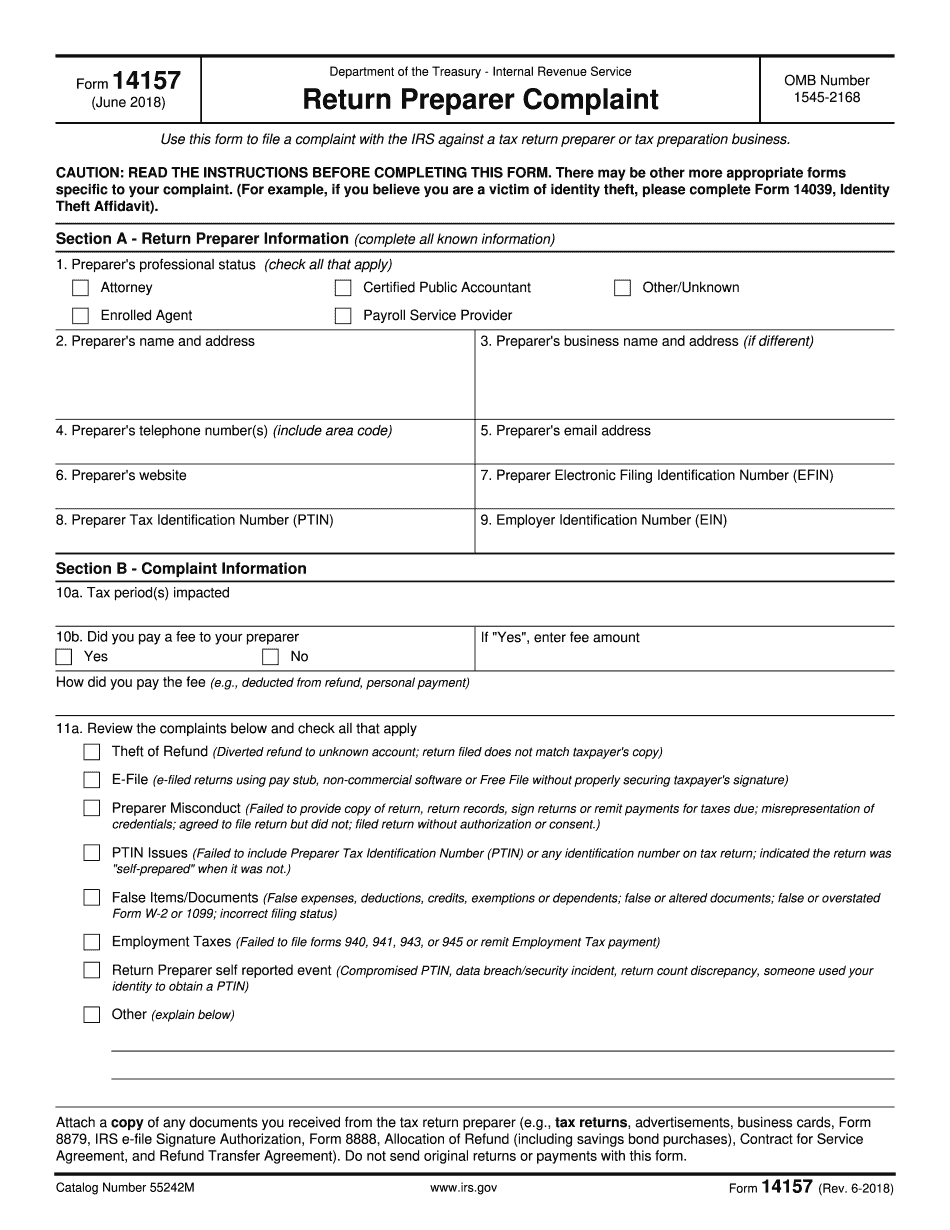

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14157, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14157 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14157 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14157 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Tax preparer filed my taxes without my consent