Award-winning PDF software

Aurora Colorado online Form 14157: What You Should Know

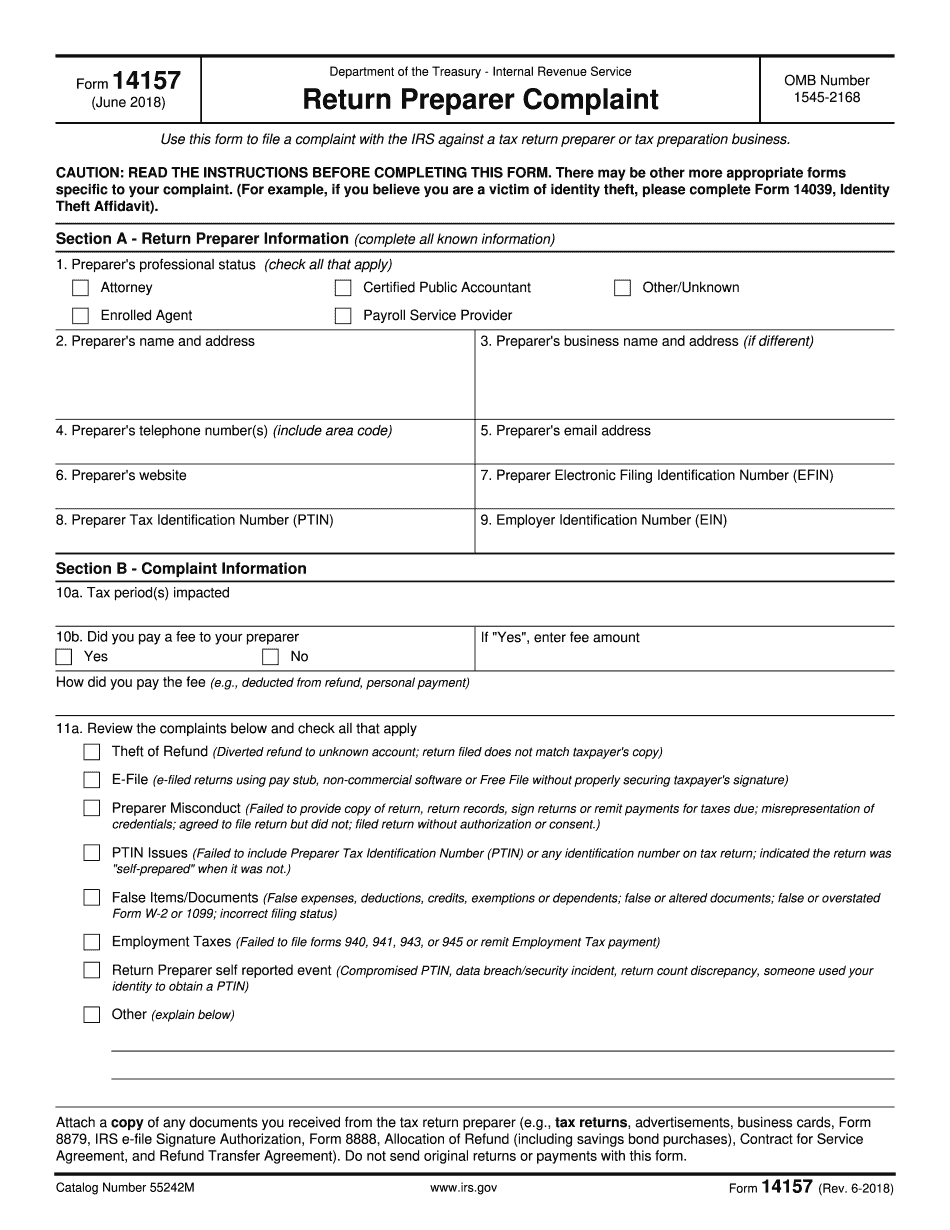

City of Aurora. Tax Form for the City of Aurora. This form is for filing taxes, including any taxes due for the City of Aurora. It may be used by a taxpayer who wants to: 1. File their own taxes. 2. File your taxes. 3. Send us your taxes. 4. File with a person or company you are not legally an agent of. 5. File on behalf of someone else. 6. Get copies of your taxes. 7. Has someone copied your taxes for you. 8. Make deductions for their taxes. 9. Take advantage of special provisions. 10. Get information about your state or county tax program. 11. File a joint return. 12. Apply to transfer assets. 13. File a joint state return. 14. Provide information to other governmental entities and/or IRS agents. 15. Use a copy machine. 16. Change or cancel your address for filing, reporting or paying your taxes. 17. Filing Errors on Your Taxes (PDF) (PDF). Download the PDF (4) Injunction in Civil Cases — State of Wyoming State Supreme Court. This form is for entering a permanent court order that prohibits the taxpayer from engaging in any fraudulent, dishonest, deceptive or unlawful conduct in connection with his or her business; to secure an equitable relief (including a monetary or equitable relief) by a court; or to enforce any right, privilege, duty, requirement or covenant that is necessary or convenient to enforce any right of a claimant that it may have regarding or in connection with the business activity of a taxpayer. All the above actions by the Taxpayer require a separate judgment and/ or order. 1. Download the PDF Filing an Interim or Preliminary Statement of Income — City of Aurora If you are uncertain about how much you have to report from the latest income tax statement, fill out this form to have a judge determine the amount due and issue an order to correct the error. You must submit a signed and notarized order to show that the error is caused by you. You will also need to pay a fee to file the statement. Furthermore, you may also use these forms to resolve a dispute where you have a disagreement about the amount of tax you have. (5) Tax Lien and Attachment Statement (PDF) — City of Aurora If you have a tax lien or attachment, use this form to make an offer to sell at public auction or deposit into a savings bond account at a bank.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 14157, keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado online Form 14157?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 14157 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 14157 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.