Award-winning PDF software

Form 14157 for Syracuse New York: What You Should Know

New York Tax Help New York, a tax preparation resource for New York taxpayers. “Our customers are overwhelmingly in the bottom half of New York households, with the average income in the bottom five percent of New York households being less than 33,600 a year,” said John Git tin, president and CEO (CEO) of Git tin Inc., the tax preparation service that provided the free tax help. New York Tax Help New York is a tax preparation service for New York households, consisting of hundreds of New Yorkers serving every borough: East and Westchester, Nassau, Suffolk, Onondaga, Orange and Albany counties. This year, NY TAH will have more than 800,000 New York households using the free tax help service, said Git tin. The free help service will be offered through Fittings subsidiary, TEA Inc. NY TAH is an affiliate of Git tin Inc. which is headquartered in Syracuse, NY. New York Tax Help New York is a program supported by the City of Syracuse economic development office and operates with the support of the Syracuse Economic Development Corporation through the Office of Economic Development. For questions, call, Monday through Friday from 9 a.m. to 6 p.m., or fax, Monday through Friday from 9 a.m. to 5 p.m. Git tin Inc. is a free tax preparation service that provides tax advice and filing assistance service to those who qualify. New Yorkers receive guidance and assistance in: New York State income tax Social Security (including Supplemental Security Income) tax refund Social Security (including Supplemental Security Income) tax credit information on how to file electronically and on how to determine eligibility for New York State programs like Supplemental Security Income (SSI), Food Stamps, Medicaid (Medicaid/TANK), and Tax-Fare Credit. New York State tax return preparation Tax refunds, including the Earned Income Tax Credit New York State corporate and business income tax Social Security Disability Benefits Tax preparation in Syracuse New York. Our tax preparation service services are available by appointment only. We recommend that prospective customers contact us to schedule an appointment as there is a large volume of applicants during the registration period for our services.

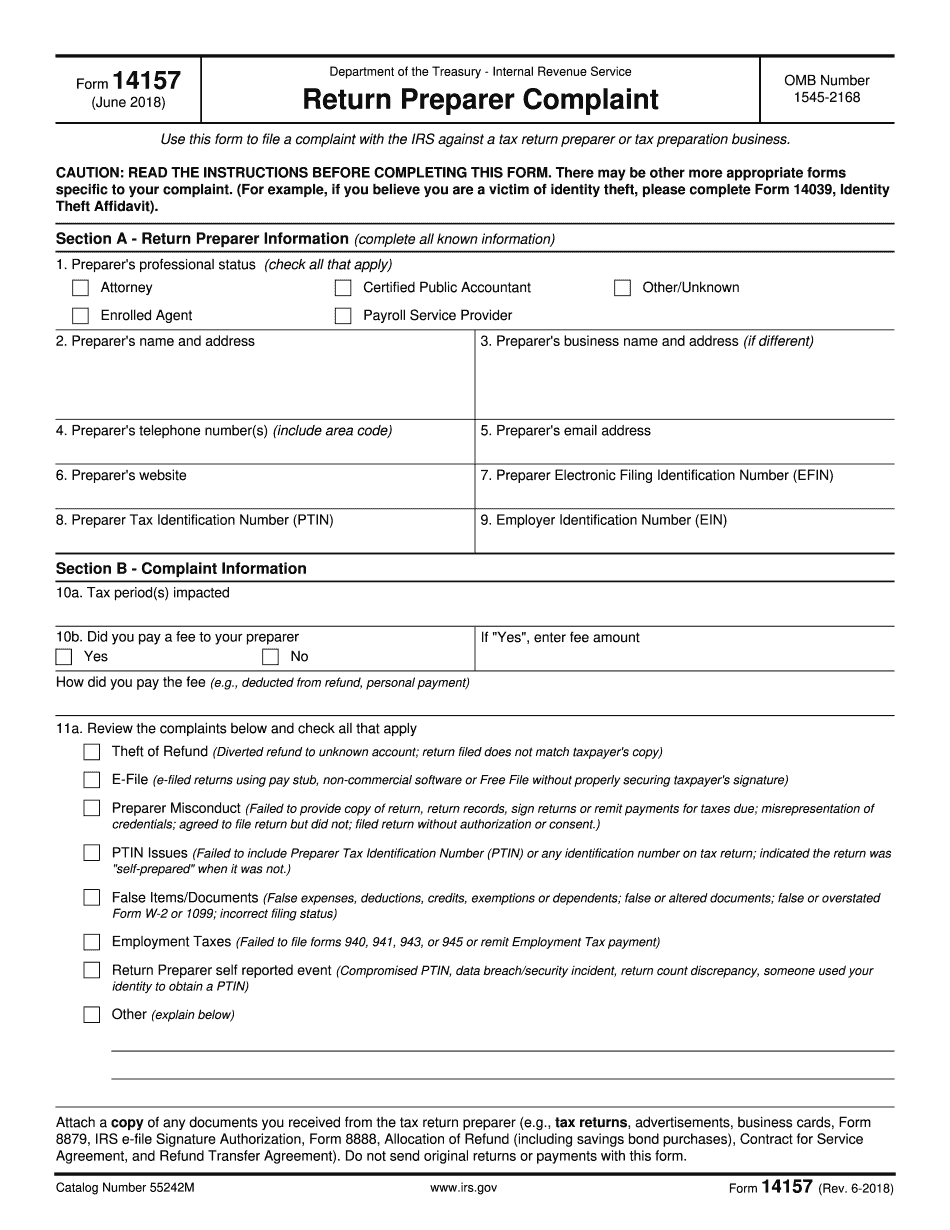

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 14157 for Syracuse New York, keep away from glitches and furnish it inside a timely method:

How to complete a Form 14157 for Syracuse New York?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 14157 for Syracuse New York aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 14157 for Syracuse New York from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.