Award-winning PDF software

Form 14157 Sandy Springs Georgia: What You Should Know

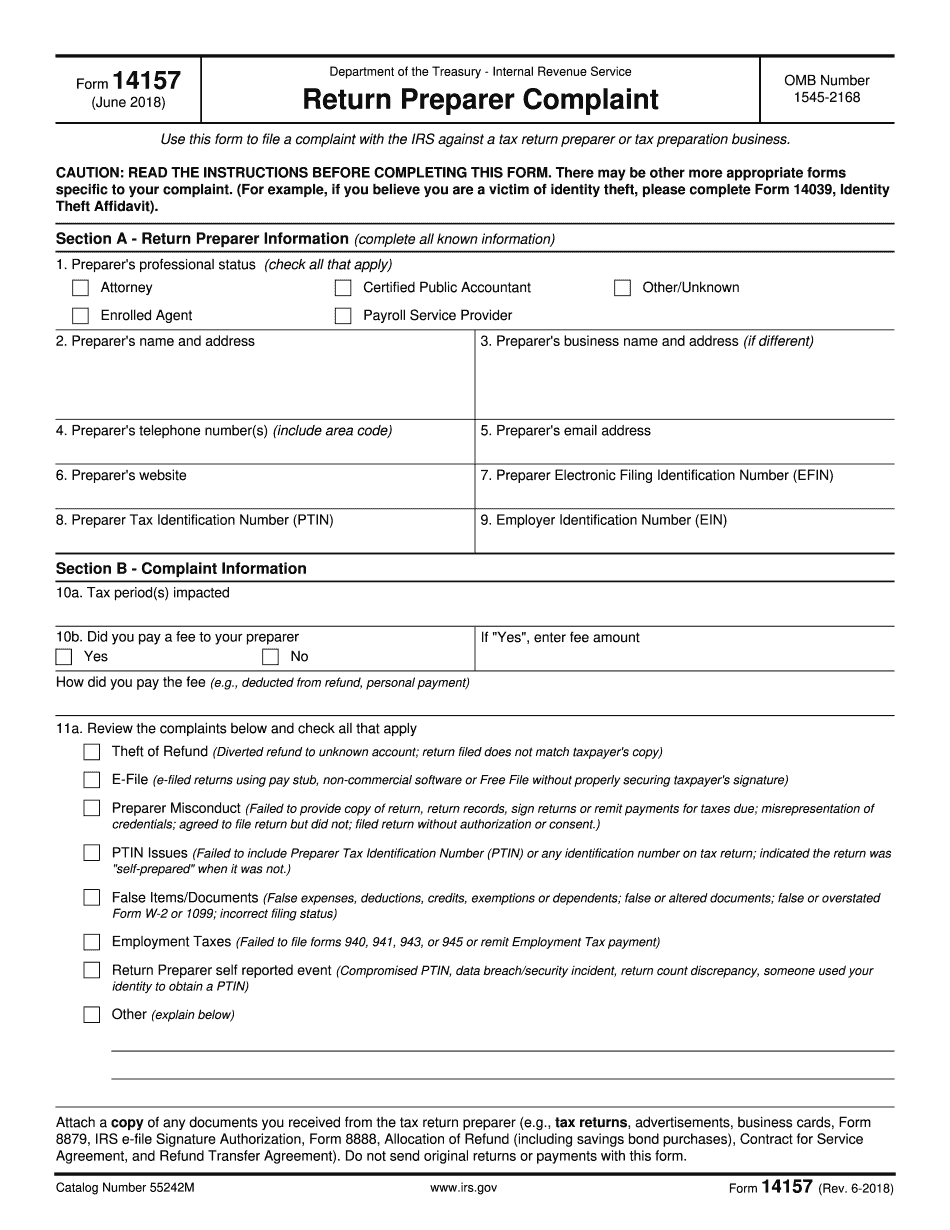

Choose from a variety of paper or online formats to ensure best-suited for your needs. Edit and print on any printer. Our new “Share” feature will allow you to keep track of document changes and to share them with anyone with the link you've stored on your computer. 14157A Form Preparation Form Online — My Document's PDF form editor makes it quick and easy to update all the information on the original 14157-A form and adjust the information accordingly. My Document's innovative PDF workflow is compatible with Microsoft Word, Microsoft PowerPoint, Adobe Acrobat, PDF, and other word processing programs. The first PDF file in the world, it's no wonder that I'm proud to offer its free version, My Document, as an extension for our customers. No need to register, no login, no sign-up, simply import and edit PDFs in minutes. My Document enables you to easily create and save your tax return as well as a copy of your tax return without the need to sign in or fill out any forms. Simply click the link in My Document and save as a PDF. Tax Preparer (Professional) Fraud or Misconduct? IRS.gov/13-14157-G Filing Form 3949– IRS Form 3949 Fraud/Misconduct — IRS A fraudulent or improper return is one that contains items in violation of the tax laws. You should report these type of violations to the IRS immediately. You also have the option to file Form 3949 (Tax Request) to request repayment of any taxes you owe on such tax return. Furthermore, you are required to send Form 3949 to: File Form 3949 (Tax Request) with your tax return 14157-A Fraud/Misconduct — IRS This form must be filed by an individual, partnership, or corporation that engages in tax fraud or misconduct through false or fraudulent representation. 14157A Fraud/Misconduct — Filing Form 3949 If you believe that an employer has acted improperly in providing tax or social security numbers, it is important that you notify the IRS promptly. File Form 3949 (Tax Request) with your tax return. For general information on preparing and filing your tax return, visit the Internal Revenue Service at. We specialize in filling 1313, 1329, 1501, and 2106. However, we also fill 1413 and 3949.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 14157 Sandy Springs Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 14157 Sandy Springs Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 14157 Sandy Springs Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 14157 Sandy Springs Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.