Award-winning PDF software

Jacksonville Florida Form 14157: What You Should Know

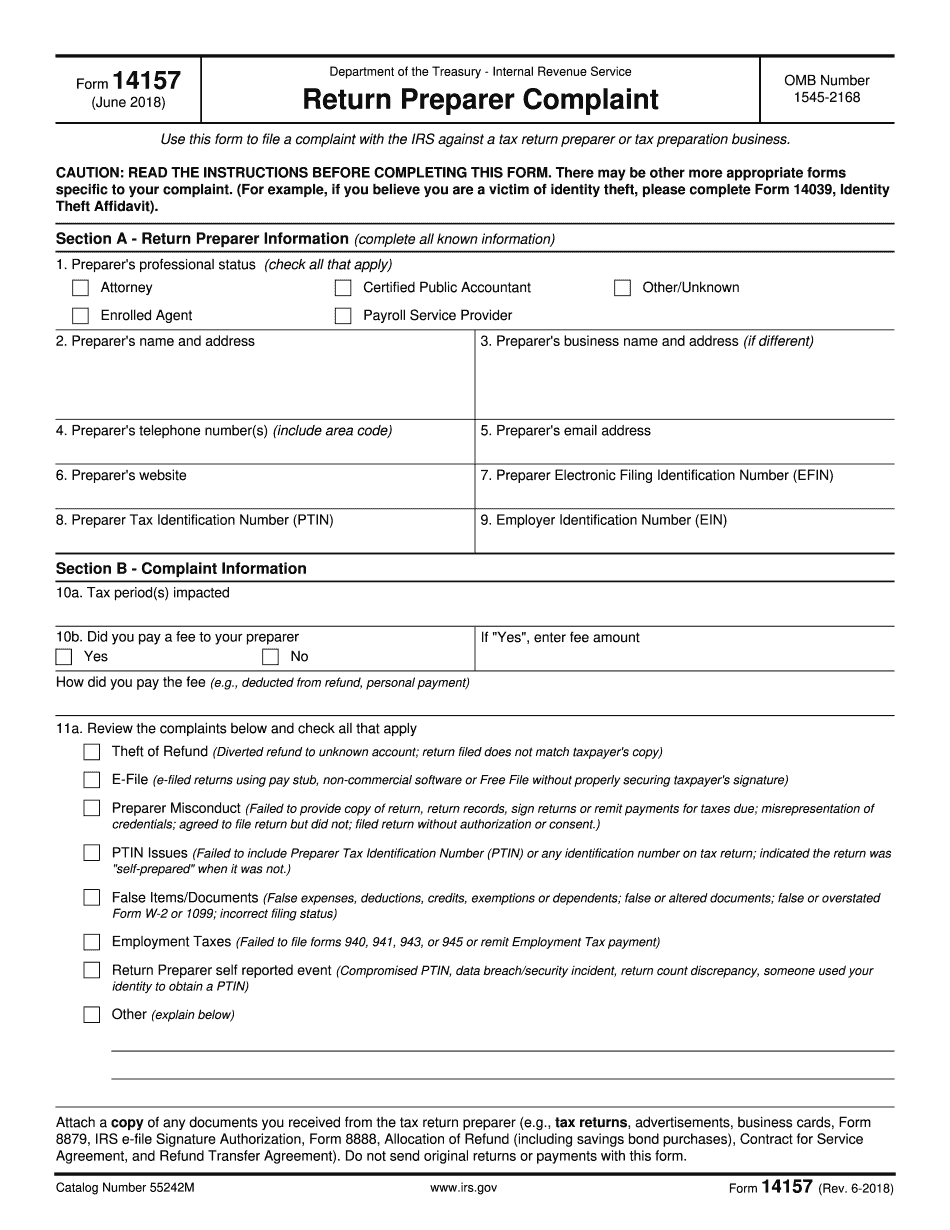

IRS Form 14157-A: General Misconduct Report The following is a link to a news story that contains excerpts from the report, but we recommend you go through the entire document and send the appropriate form to the IRS. JERSEY DEPT. OF TAXATION, VIRGINIA, REVIEW OF “THE IRS FORM 14157 INSTRUCTIONS” FOR IMPORTANT ADOPTIONS TO THE FORM IRS Form 14157 — General Misconduct Report — The IRS encourages taxpayers to make sure that all tax preparers they do business with are up-to-date on the latest guidance on the new federal tax law. The guidance is available as a link to online version of the form. IRS Commissioner's Letter for Taxpayers IRS Commissioner's Letter for Taxpayers — 2025 Tax Filing Season · May 26, 2025 · For Taxpayers who are preparing their personal and a variety of business tax returns for this tax filing season, the commissioner is hereby providing guidance on the new federal tax law — the Tax Cuts and Jobs Act. The commissioner encourages all taxpayers and tax professionals to review the guidance provided in this letter. The Commissioner will not issue any further guidance. We will continue to work with the IRS to ensure taxpayers fully understand the new federal tax law, what it does to their taxes and how to comply with the law. Taxpayers seeking clarification on the tax law with regard to Schedule D, which includes Schedule A, must direct request for clarification to their taxpayer representative or contact the IRS toll-free at 1-800-TAX-FORM. Taxpayers need to understand that a tax professional is doing work that's not a commercial transaction between an organization and an individual, and therefore it is not covered by the regulations governing the commercial nature of this activity under the “Exceptions to Form W-2, Wage and Tax Statement,” section 20. The commercial nature is a significant distinction between an educational organization and a business that prepares one-time returns, e-file the returns or issues electronic returns, and thus does not fall within a commercial transaction. However, it does have some important exceptions. As an organization preparing tax returns for tax purposes, Tax Professional Associations are required to file Form 1065 each year to certify to their members that: 1.) They are registered with the IRS (see IRM 21.1.2.1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Jacksonville Florida Form 14157, keep away from glitches and furnish it inside a timely method:

How to complete a Jacksonville Florida Form 14157?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Jacksonville Florida Form 14157 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Jacksonville Florida Form 14157 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.