Award-winning PDF software

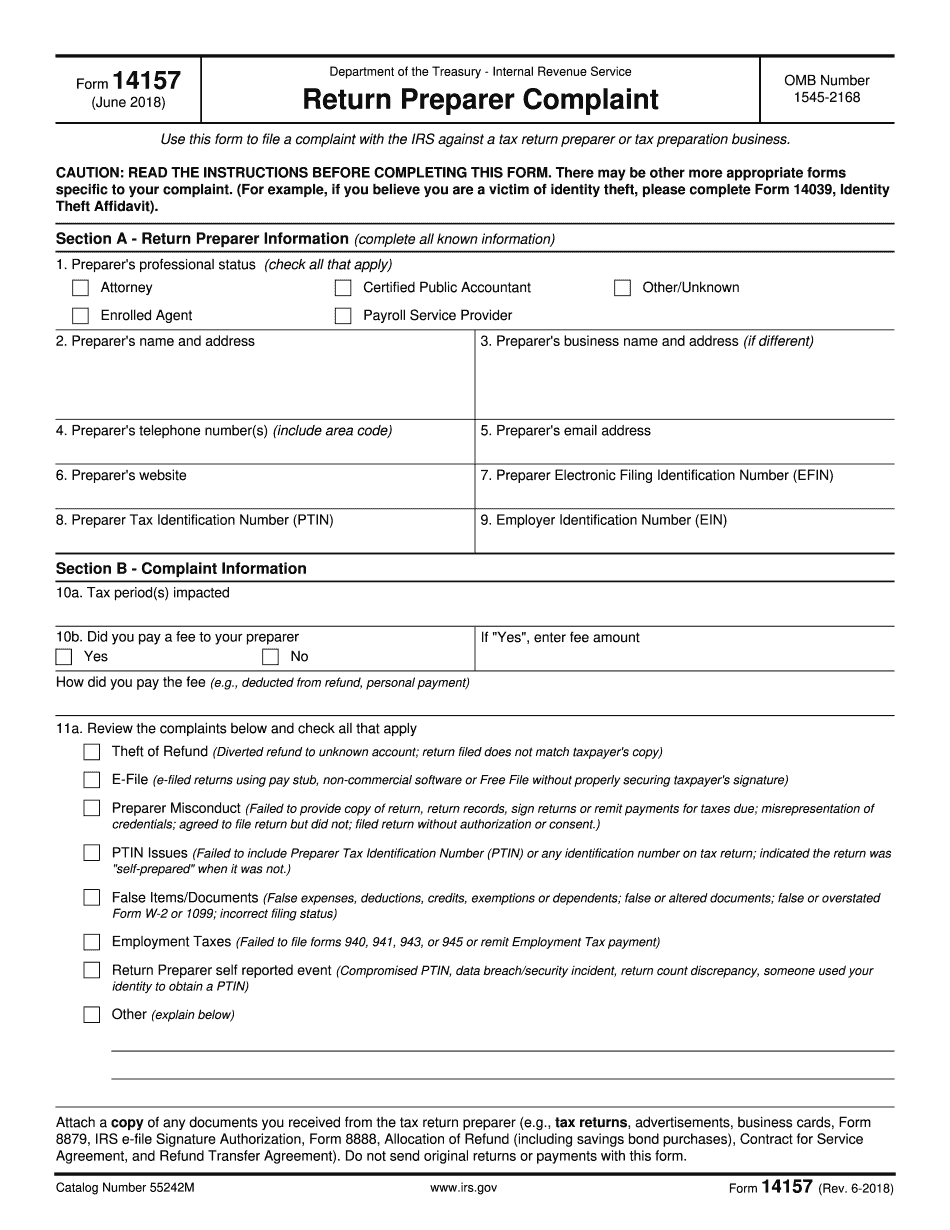

Lee's Summit Missouri online Form 14157: What You Should Know

Missouri Statute 639,200. You must file Form 53-C with the Missouri Department of Revenue within 7 days of the day on which goods purchased, or services rendered are received. If you do not file your 53-C, the IRS can assess and collect that amount from you. If you do not pay the tax, the IRS may add interest at a rate of 10% per month, in addition to the interest and penalty imposed under section 4662(d). If the tax is not paid when due, the statute of limitations is reset to the day you first knew that it was overdue. If you have already filed your 53-C and filed an extension with the Missouri Department of Revenue, the tax is collected. If you need a form for use in another State, contact your local agency which has a tax office. Use the IRS.gov website to view and print your free copies of the form. Use Form 1310-A to file a complaint against an individual or entity who filed a federal income tax return or did any of the following: Filed a Form 1040 series income tax return that does not identify the taxpayer, the taxpayer's spouse, dependents, or the taxpayer's estate as a separate entity. Sent a check, money order, or other payment based on a Form 1040 series income tax return for someone that does not apply to himself. Falsely claimed a deduction of any amount on a tax return for which that taxpayer is not entitled to a deduction. Filed a tax return that does not contain a complete and accurate box on which deductions are claimed for items such as interest, self-employment tax, property taxes, or taxes on wages or other wages. File an amended tax return within the prescribed time periods or, if such time periods have expired, to correct a mistake. Cited information does not contain the necessary information to make an accurate tax calculation or to make a fair and reasonable tax return. Form 8861 Return for Tax Year 2025 — Chub The tax return you prepare may be used for: The tax return you prepare may be used for: Form 940 — Income Tax Return. See Pub. 526, Tax Guide for Small Business. Form 1040, 1040A and 1040EZ. See Pub. 526, Tax Guide for Small Business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Lee's Summit Missouri online Form 14157, keep away from glitches and furnish it inside a timely method:

How to complete a Lee's Summit Missouri online Form 14157?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Lee's Summit Missouri online Form 14157 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Lee's Summit Missouri online Form 14157 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.