Award-winning PDF software

McAllen Texas Form 14157: What You Should Know

IRS Publication 14, Tax Guide for Small Business and Self-Employed is an excellent introduction to the tax filing requirements with each of the three personal tax rates, the 1040, the 1040NR, and 1040ES instructions. This volume contains tax tables and a number of other useful tax guides. IRS Publication 15, Tax Guide for Small Business and Self-Employed, is the main professional tax publication for tax professionals. It lists all the deductions and credits and also addresses the business tax rules. IRS Publication 16, Tax Guide for S Corp (S Corps), is for the tax-exempt status of Small Business corporations organized under the laws of the states of the U.S. This publication contains various tax rules and forms, including a section on the application for IRS recognition of tax-exempt status. IRS Publication 17, Tax Guide for Farm and Forest Companies, is a comprehensive guide to the tax-exempt status of agricultural and forestry companies. The book includes a comprehensive table of contents addressing all tax-exempt status requirements and regulations. IRS Publication 18, U.S. Individual Income Tax Return and the Instructions, provides complete instructions for filing your return, describing all the tax rules which apply to your personal return. IRS Publication 19, Tax Guide for Individuals, is the definitive guide to preparing and filing individual tax returns. This book contains tables, instructions, and detailed explanations of each of the tax requirements affecting individuals. IRS Publication 20, Tax Guide for Small Business includes information on most tax-related topics and provides information on federal corporate tax provisions. The publication discusses the U.S. tax rules concerning corporations, partnerships, and S Corps. IRS Publication 21, Tax Guide for Tax Exempt Organizations addresses tax law, tax regulations and requirements of tax-exempt organizations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete McAllen Texas Form 14157, keep away from glitches and furnish it inside a timely method:

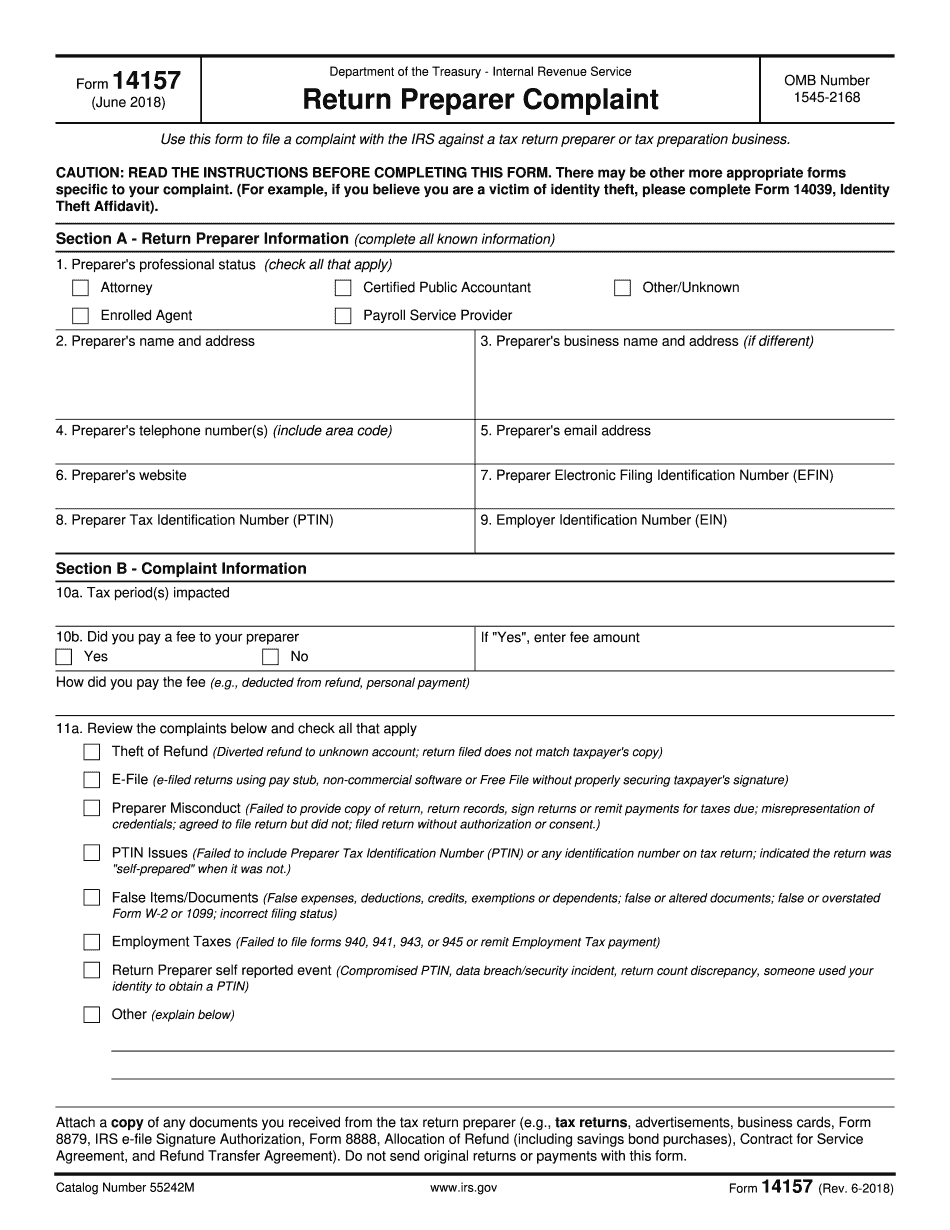

How to complete a McAllen Texas Form 14157?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your McAllen Texas Form 14157 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your McAllen Texas Form 14157 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.