Award-winning PDF software

Form 14157 for Georgia: What You Should Know

Use both documents together to make a comprehensive complaint. The complaint should be emailed to: IRS Complaint Manager, Tax Compliance, Chubb Federal Credit Union, P.O. Box 919, Chubb, Arkansas 72 Filing a Fraudulent Tax Return PDF by the IRS Use Form 1663 to file a fraudulently obtained return. It can be completed on or before the due date of the return. Fill out an electronically signed Form 1663 form and mail it with an itemized statement to: IRS Criminal Investigation Division, Taxpayers' Liability Branch, P.O. Box 81009, Atlanta, GA 30 Filing a False Income Tax Return, and Miscellaneous Refund Claim by the IRS If you file a tax return and fail to provide a copy of: · Your completed Form 1040NR (or 1040NR-EZ for the 2025 tax year) ; · The federal Form 1040 or 1040A ; · A copy of your Social Security Number ; · Your Georgia Individual Income Tax Return ; · A copy of any relevant federal income tax returns (including extensions); or · Any proof, other than statements provided by the preparer, that the tax for the calendar year was calculated on a different schedule from the schedule shown on the return, you will receive a deficiency on your return for the calendar year. If you also file a claim for the refund of any tax withheld at the source as part of an installment agreement, you must include certain information with your return. If you do not provide any of the required information, you will be considered to have provided a false statement or failure to file. For this reason, you should submit a supporting Form 5329, Claim for Refund of Taxes Withheld at Source. Use Form 5210-B, Claim for Refund of Taxes Withheld at Source, to request a refund of taxes withheld at the source. Submit the Form 5210-B to the Internal Revenue Service center nearest you, and allow at least seven days for processing. Your refund will be processed within three months. Use Form 5225, Claim for Refund of Overpayments, or a claim number issued by the IRS, to request a refund of overpayments. Submit the Federal Form 2555 to receive a refund of overpayments made to you by your employer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 14157 for Georgia, keep away from glitches and furnish it inside a timely method:

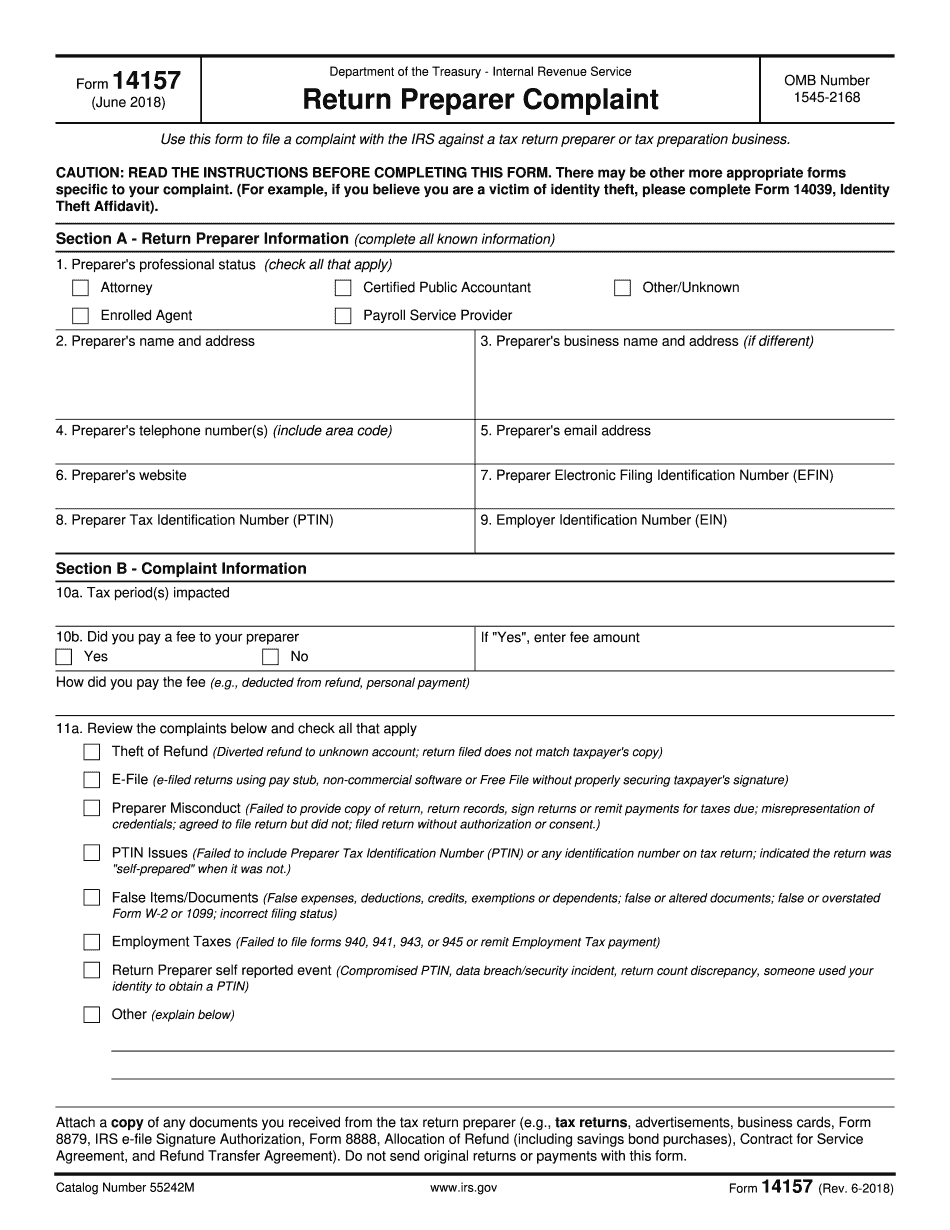

How to complete a Form 14157 for Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 14157 for Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 14157 for Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.