Award-winning PDF software

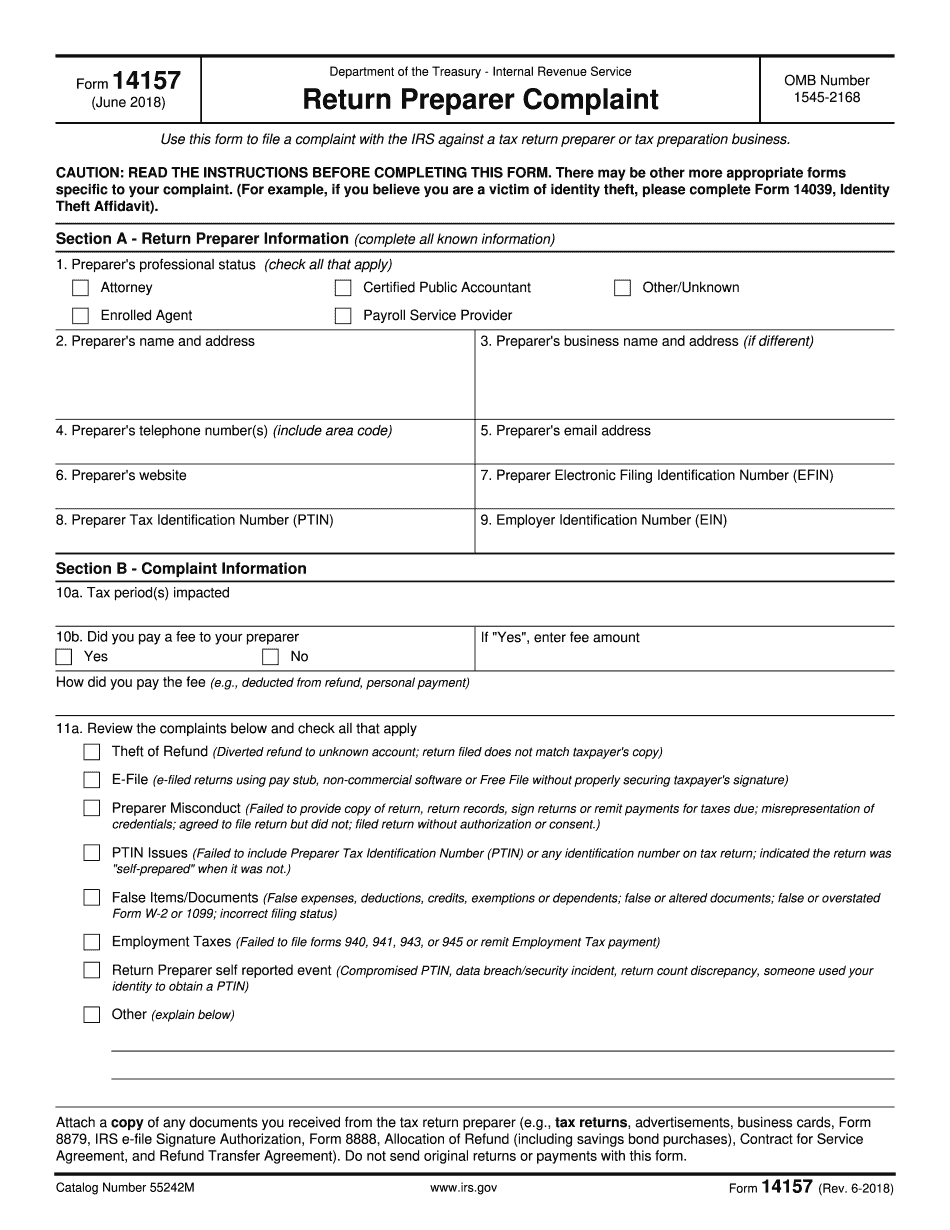

South Dakota Form 14157: What You Should Know

Learn what the Form 14157 is, how it's used, and who is affected. Related Content Form 1099–G Reporting Tax Preparer Fraud and Misconduct Did you know IRS Form 1099-G Reporting Tax Preparer Fraud or Misconduct? I talked about this form here. What is “Form 1099-G”? It's reporting taxes withheld on wages or other income of people who are not U.S. taxpayers. More about Tax Returns Fraud & Other Fraud: The following list describes various types of tax return fraud: Tax-Related Fraud (aka Tax Fraud) — In order to meet its goal of getting more money into the hands of the federal government through more tax revenue, the IRS is a very lucrative business. Taxpayers are enjoying this because of the money they are able to get back in taxes that the government collects. If you do not report any of the following types of tax fraud, the IRS may charge you penalties and tax collection fees: False claims of identity and misrepresentation; False statements; Fraudulent deductions; Tax evasion or evasion; Illegal use of a taxpayer ID; Illegal entry. Check out my new book, The Truth About IRS Tax Forms and Reporting Tips ; see if you'd like a free copy by using the form here. A Tax Preparer's Guide to Fraud Prevention and Avoiding Fraud, the IRS Guide to IRS Tax-Related Fraud and False Claims is also available here IRS Form 278E — Form 278E Fraud Remediation Plan Learn about the most common scams that IRS auditors are looking out for, including: If you receive a notice of tax audit, don't panic! Keep track of your records and be prepared for the audit. The only way to avoid these scams and avoid having your refund withheld by the IRS is to follow our fraud prevention strategies in the guide above: IRS Form 138 — Form 138 Fraud Remediation Plan Learn about the most common scams that IRS auditors are looking out for, including: See my page on IRS Criminal and Civil Penalties or click on the link below: IRS Criminal and Civil Penalties: IRS Criminal and Civil Penalties Related Information South Dakota: Fraudulent Return Preparer/Tax Fraud New York: IRS Form 1320: Nonbank Financial Institution.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete South Dakota Form 14157, keep away from glitches and furnish it inside a timely method:

How to complete a South Dakota Form 14157?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your South Dakota Form 14157 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your South Dakota Form 14157 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.