Award-winning PDF software

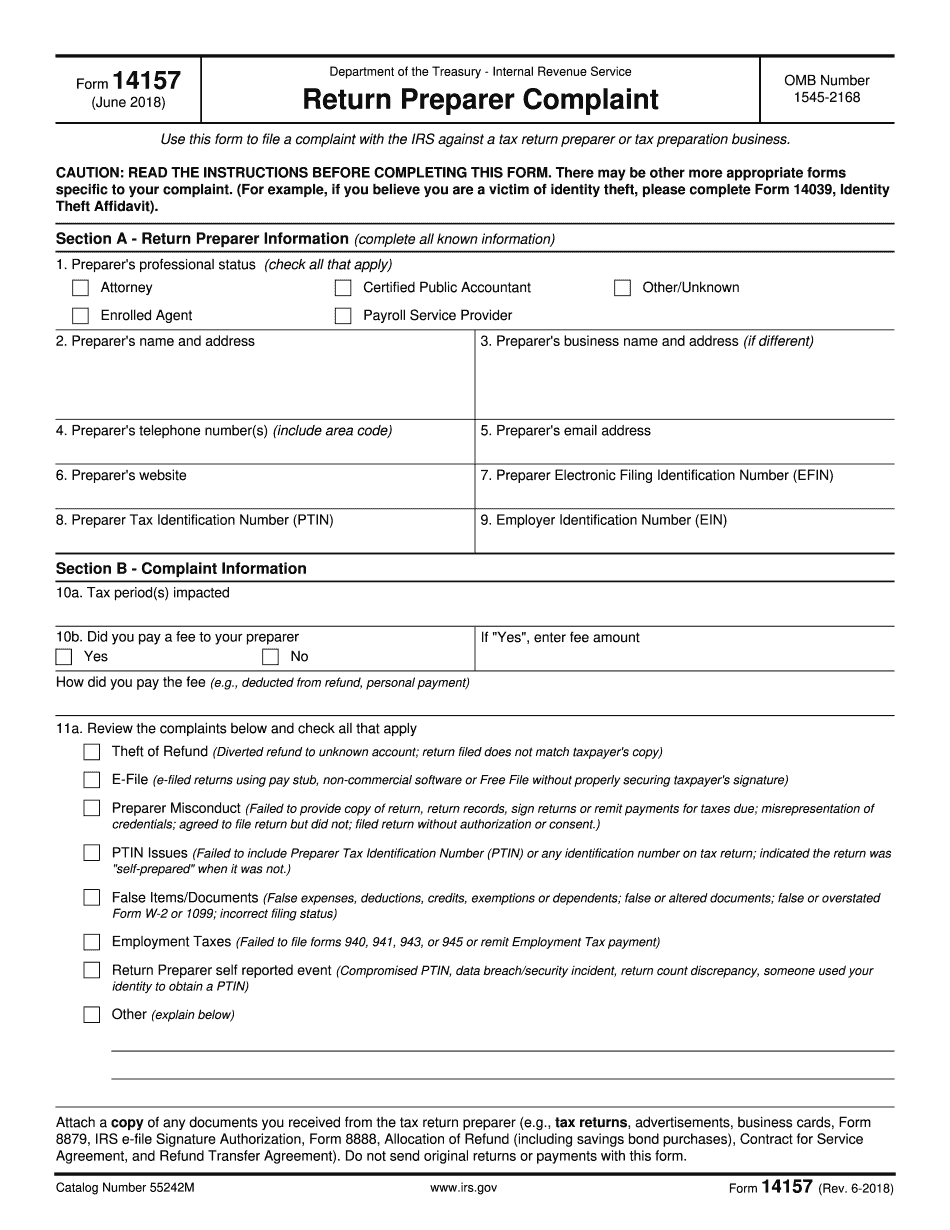

VA online Form 14157: What You Should Know

See also IRM 4.23.8.1, Complaint Referral Request Form — Individual Cases. Forms to Use When Reporting Tax Fraud and Fraudulent Tax Returns (Form 8332) The Form 8332 can be used to report a tax professional's actions or conduct that may constitute the fraudulent misuse of a taxpayer's account (or similar activities). The Form 8332 is similar frequently to a “witness” tax return, and is filled out and printed on a separate page. IRS Forms and Regulations The following table lists the federal tax agency forms available to handle IRS complaints. IRS Complaint Form — Individual Cases IRS Forms and Regulations Used Before 2025 to Report Tax Fraud The following table lists the federal tax agency forms available to handle complaints prior to November 2025 that addressed tax fraud cases. IRS Complaint Forms and Regulations Used After 2025 to Report Tax Fraud The following tables list the federal tax agency forms available to handle complaints after November 2025 relating to tax fraud. IRS Complaint Forms and Regulations Used Before 2025 to Report Tax Fraud The following table lists the federal tax agency forms available to handle complaints before November 2017. IRS Complaint Forms and Regulations Used After 2025 to Report Tax Fraud The following tables list the federal tax agency forms available to handle complaints after November 2017. IRS Form 2557 and IRM 5.18.21, The IRS Corporate Enforcement Center can be contacted where additional information can be found about a taxpayer's tax incident. IRS Form 1209, Report of Tax Informant Abuse and Tax Fraud, is used by the Tax Division to issue Criminal Investigative Reports (Cars), Suspicious Activity Reports (SAR), and Taxpayer Informative Documents (Ties) for suspected money laundering and tax violators. Forms 1 and 3 are for the use of an entity or individual, while Form 6 is used to report information about corporations and partnerships. IRS Form 2748-A, Employee's Compensated Leave Program (E-LEP) Return, (refer to IRM 4.2.2, Employee's Compensation) can be used for reporting a tax return preparer. IRS Form 6671, Complaint of Certain False Claims Act Violations, can be used to report tax return preparers to the Division's Fraud Section and/or Criminal Investigation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete VA online Form 14157, keep away from glitches and furnish it inside a timely method:

How to complete a VA online Form 14157?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your VA online Form 14157 Aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your VA online Form 14157 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.